According to a study by Credit Loan, three in four Americans say they’re living paycheck to paycheck. Picture this: you’ve been working hard all month, but when an unexpected medical bill shows up, it throws your entire budget off balance. Instead of feeling secure, you’re left scrambling to make ends meet.

This is where financial education and planning become crucial. And it all starts with understanding what is wealth building. In simple terms, wealth building is the process of growing your money over time through smart financial decisions, savings, and investments. It’s about creating a system where your money works for you—so unexpected expenses don’t leave you stressed, and you can build towards financial freedom with confidence.

What is Wealth Building?

Wealth building is the process of creating long-term financial stability and independence by consistently saving, investing, and acquiring income-generating assets. In simpler words, it’s about making your money work for you rather than you constantly working for money.

Instead of relying only on a paycheck to cover your day-to-day needs, wealth building helps you create financial assets—such as stocks, real estate, or retirement funds—that can generate income, appreciate in value, and provide financial security over time.

Think of wealth building like gardening. You start with seeds (your income), nurture them with water and sunlight (smart financial decisions like saving and investing), and after some time, you end up with a flourishing garden that produces fruits (steady income and assets). The earlier you start planting, the bigger your harvest will be.

Why is Wealth Building Important?

Wealth building goes far beyond “getting rich.” It’s about creating financial freedom, reducing stress, and building a foundation for yourself and future generations. Here’s why it matters:

- Financial Security – Life is unpredictable. Having built-up wealth means you’re prepared for emergencies like medical bills, car repairs, or job loss.

- Freedom from Paycheck-to-Paycheck Living – Relying on just one income stream can be stressful. Wealth building allows you to diversify your income sources.

- Retirement Readiness – Social Security alone may not cover future needs. Wealth building ensures you can maintain your lifestyle when you stop working.

- Generational Wealth – The assets you create today—whether investments, property, or businesses—can be passed down to your children and grandchildren.

- Peace of Mind – Knowing your money is working for you allows you to focus on living life, not just surviving financially.

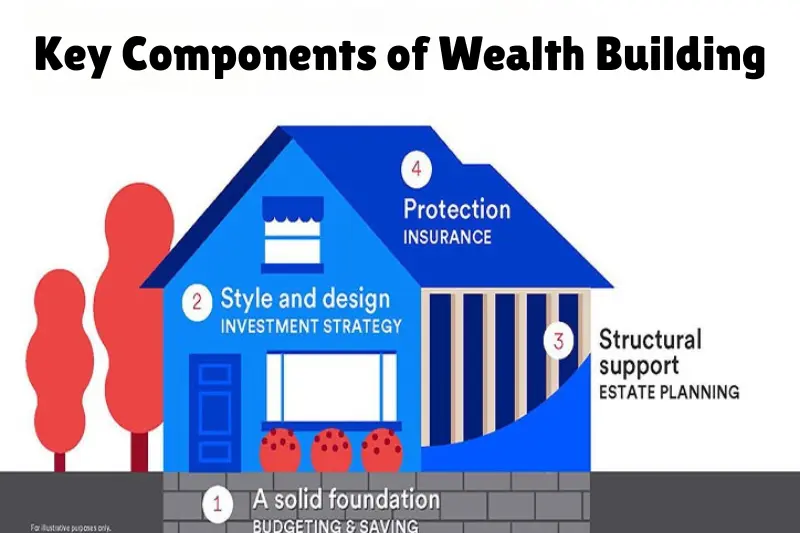

Key Components of Wealth Building

Building wealth doesn’t happen overnight, but with consistency and smart decisions, it’s achievable. Here are the essential pillars of wealth building:

1. Financial Education

Knowledge is the foundation of wealth. Without understanding how money works, it’s easy to make poor financial choices. Financial education includes learning about:

- Budgeting effectively

- Managing and avoiding debt

- Understanding compound interest

- Learning investment strategies

- Building credit responsibly

For example, someone who knows the difference between good debt (like a student loan with long-term benefits) and bad debt (like high-interest credit cards) is already on a better wealth-building path.

2. Savings

Before you start investing, it’s important to have an emergency fund. This is typically 3–6 months of living expenses set aside in a savings account. It acts as a safety net, protecting you from dipping into your investments when unexpected expenses occur.

Think of savings as your financial cushion—it doesn’t grow wealth much, but it prevents you from falling backward.

3. Investments

Investing is the engine of wealth building. While savings protect you, investments grow your money. Common investment options include:

- Stocks and Bonds – Stocks can generate growth, while bonds provide stability.

- Real Estate – Rental properties or real estate funds can provide both income and appreciation.

- Retirement Accounts (401k, IRA, Roth IRA) – These accounts allow tax advantages that accelerate long-term growth.

- Mutual Funds and ETFs – Diversified investments that reduce risk while offering steady returns.

The secret is consistency. Even small amounts invested regularly compound over time. For example, investing $200 a month with a 7% return could grow into over $240,000 in 30 years.

4. Multiple Income Streams

Relying on a single paycheck is risky. Wealth building encourages you to create additional streams of income, such as:

- Side hustles (freelancing, consulting, online businesses)

- Passive income (dividends, royalties, or rental income)

- Entrepreneurship (starting a small business)

This not only increases your income but also reduces financial vulnerability.

5. Asset Accumulation

Wealth isn’t just about cash—it’s about building assets that hold or grow in value. Assets may include:

- Real estate properties

- Dividend-paying stocks

- Businesses

- Collectibles or intellectual property

Unlike liabilities (like credit card debt or car loans), assets make money for you over time.

You may also like to read this:

8 Types of Smart Investment Options: Beginner-Friendly Guide

How To Invest In Stocks For Beginners And Grow Your Money

Why Diversification Is Important In Investing Explained

7 Best Smart Investing Apps and Platforms To Use In 2025

Active Investing Vs Passive Investing: Which Strategy Wins?

Common Misconceptions About Wealth Building

Many people avoid wealth building because of myths or misconceptions. Let’s clear up a few:

- “I need to be rich to start.” – Wrong. Wealth building is about small, consistent actions. Even saving $20 a week makes a difference.

- “It’s too risky.” – While some investments are risky, proper research, diversification, and long-term planning minimize those risks.

- “It takes too long.” – True wealth is built gradually, but that’s the point—it lasts. Starting early allows compound interest to work its magic.

Practical Tips to Start Wealth Building Today

Ready to begin? Here are some simple steps to start wealth building right now:

- Track Your Spending – Know exactly where your money is going each month.

- Create a Budget – Assign your income to needs, savings, investments, and fun.

- Build an Emergency Fund – Secure 3–6 months of expenses before diving deep into investments.

- Pay Down High-Interest Debt – Debt with 15–20% interest will undo all your wealth-building progress if ignored.

- Start Investing Early – Automate contributions to retirement accounts or stock market investments.

- Diversify Your Income – Consider a side hustle or passive income stream to boost your wealth journey.

- Keep Learning – Read books, listen to finance podcasts, and stay updated with market trends.

The Stages of Wealth Building

Wealth building is a journey, and just like climbing a mountain, it happens in stages. Knowing where you are can help you plan your next step.

1. Foundation Stage

At this point, your focus is on stability. You’re learning to budget, control expenses, and pay down high-interest debt. Building an emergency fund is your first goal.

Action Steps:

- Track every expense to understand spending habits.

- Save at least $1,000 to cover small emergencies.

- Pay off credit card debt as quickly as possible.

2. Growth Stage

Once you’re stable, you can start building momentum. This is where you invest, create multiple income streams, and make your money grow.

Action Steps:

- Contribute regularly to retirement accounts.

- Explore stocks, bonds, or real estate investing.

- Start a side hustle to add extra income.

3. Expansion Stage

Here, you’re scaling wealth. You already have investments and assets working for you, and now it’s about optimizing, diversifying, and protecting your wealth.

Action Steps:

- Diversify investments across industries and asset types.

- Acquire income-producing assets like rental properties.

- Reinvest profits from side businesses or investments.

4. Preservation Stage

In this stage, you’ve built significant wealth, and the priority shifts to protecting and preserving it for retirement and future generations.

Action Steps:

- Create a will or estate plan.

- Invest in life insurance or trusts.

- Focus on tax-efficient investment strategies.

Wealth Building Strategies for Long-Term Success

To truly understand what wealth building means, you need practical strategies that you can apply at any stage:

- Automate Your Finances – Set up automatic transfers to savings and investment accounts so you’re building wealth without thinking about it.

- Live Below Your Means – Wealth isn’t about how much you earn, but how much you keep and grow.

- Leverage Compound Interest – The earlier you start investing, the more time your money has to grow.

- Protect Your Wealth – Insurance, estate planning, and smart tax strategies help safeguard your hard work.

- Keep Investing in Yourself – Learning new skills can open doors to higher income opportunities.

Real-Life Example of Wealth Building

Imagine Sarah, a 25-year-old earning $45,000 a year. She decides to:

- Save $5,000 as an emergency fund.

- Invest $300 a month in an index fund with an average 7% annual return.

- Start a small side hustle that brings in an extra $500 a month.

By age 55, her investments alone could be worth over $370,000. Combine that with her side hustle savings and retirement contributions, and she’s well on her way to financial independence—all by starting small and staying consistent.

Common Roadblocks in Wealth Building (and How to Overcome Them)

- Impulse Spending – Use the 24-hour rule before making non-essential purchases.

- Debt Traps – Avoid payday loans or carrying high-interest balances.

- Lack of Patience – Remember, wealth is built over decades, not months.

- Fear of Investing – Start small, use robo-advisors, or consult a financial planner.

Final Thoughts

So, what is wealth building? It’s the ongoing, intentional process of creating financial freedom through smart saving, consistent investing, multiple income streams, and asset accumulation. It’s not about instant riches—it’s about long-term stability, independence, and growth.

The beauty of wealth building is that anyone can start, no matter their income level. Whether you’re saving your first $100, investing your first $500, or scaling your business profits, each step builds momentum.

The key takeaway: Start today, stay consistent, and let time and smart decisions do the heavy lifting.

Wealth building is your path to financial freedom, peace of mind, and a legacy that lasts for generations.

FAQs

1. What is wealth building in simple terms?

Wealth building is the process of growing your money over time by saving, investing, and acquiring assets that generate income. Instead of relying only on a paycheck, you create financial security and independence for the future.

2. Why is wealth building important?

Wealth building is important because it gives you financial freedom, reduces stress, prepares you for emergencies, and ensures a comfortable retirement. It also helps you build generational wealth that can benefit your children and future family.

3. Do I need a high income to start wealth building?

No, you don’t need to be rich to start. Wealth building is about consistency, not just high income. Even saving and investing small amounts regularly can grow significantly over time thanks to compound interest.

4. What are the key steps to start wealth building?

The main steps include:

Learning financial basics (budgeting, debt management).

Building an emergency fund.

Paying off high-interest debt.

Starting investments (stocks, real estate, retirement accounts).

Creating multiple income streams.

Accumulating long-term assets.

5. What are some common mistakes in wealth building?

Some common mistakes include:

Delaying investing because of fear or lack of knowledge.

Carrying high-interest debt.

Spending beyond your means.

Not diversifying investments.

Failing to plan for taxes or retirement.