Managing money isn’t just about how much you make—it’s about making sure every dollar has a purpose. Imagine this: Sarah earns a decent salary, but by the end of each month, she’s left wondering, “Where did all my money go?” That’s where budgeting comes in. Think of it like Google Maps for your finances—it helps you avoid wrong turns, track your progress, and reach your money goals without the stress.

The truth is, there’s no one-size-fits-all budget. Some people love the old-school approach of jotting numbers on paper or updating a spreadsheet, while others rely on apps that track every transaction automatically. To keep things simple, let’s break down the different types of budgeting tools into two categories: budgeting methods (the strategies you follow) and technological tools (the systems that help you stick with them).

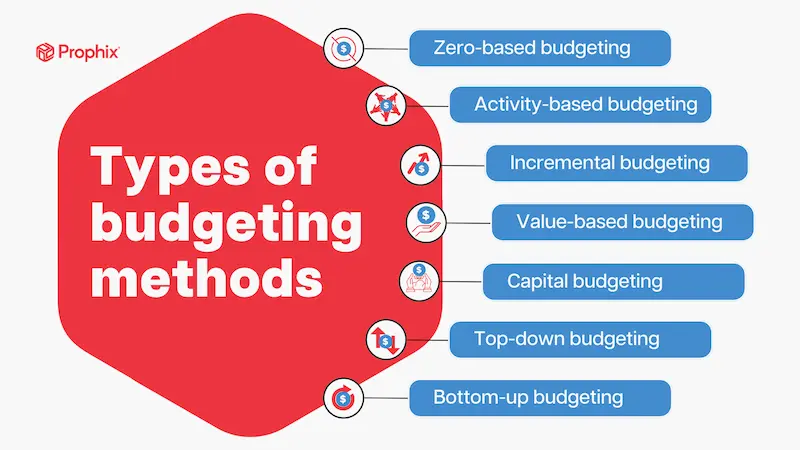

1. Budgeting Methods (The Strategy Behind the Numbers)

Budgeting methods are like playbooks for handling your income and expenses. Each comes with unique advantages depending on your goals and lifestyle.

Zero-Based Budgeting

This method gives every single dollar a mission. Your income minus expenses equals zero. That doesn’t mean you’re broke—it means all money is allocated to categories such as savings, bills, emergency funds, or even fun activities.

- Best for: People who want full control over their money.

- Example: If you earn $3,000, you might allocate $1,200 to rent, $500 to groceries, $300 to savings, $200 to debt, and the rest to utilities and leisure. No dollar is left without purpose.

Incremental Budgeting

This is the “easy-going” budgeting approach. You start with last year’s budget and make small tweaks—adding a little more where needed, or trimming down where possible.

- Best for: People with stable incomes and predictable expenses.

- Downside: It doesn’t adapt well if your income or expenses change drastically.

Activity-Based Budgeting

Here, every expense is tied directly to an activity. Businesses often use this to plan for projects or campaigns, but individuals can apply it too. For example, if you’re saving for a wedding or a big trip, you’d map out the activities involved (venue, catering, flights, hotels) and assign budgets accordingly.

- Best for: Business owners or goal-driven savers.

- Benefit: Provides precise and realistic cost planning.

Value-Proposition Budgeting

This method forces you to question every expense. Does it bring enough value to justify its cost? If not, it’s eliminated or reduced.

- Best for: People trying to cut unnecessary spending.

- Example: You might decide that a $60/month gym subscription you never use isn’t worth it, and instead switch to at-home workouts.

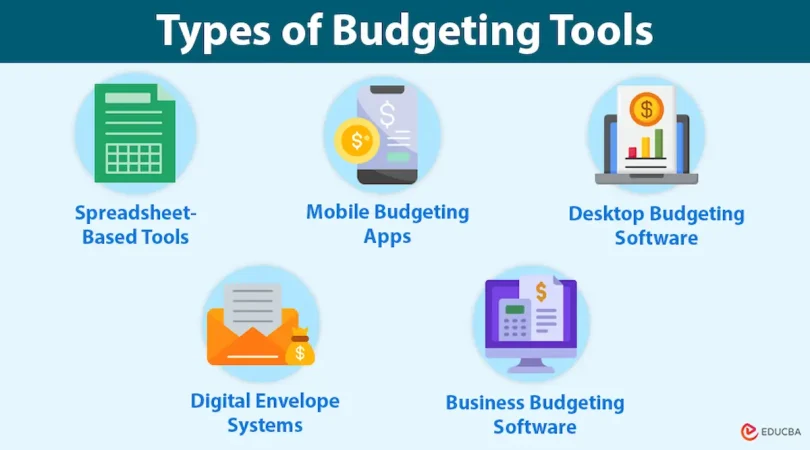

2. Technological Budgeting Tools (The Systems That Help You Stay on Track)

Once you choose a budgeting method, you need a system to put it into action. That’s where technological budgeting tools come in—ranging from low-tech options like envelopes to fully automated software.

The Envelope Method (Manual Tool)

This old-school system still works wonders for people who overspend. You divide your cash into envelopes labeled “Groceries,” “Rent,” “Transportation,” “Entertainment,” etc. Once an envelope is empty, you can’t spend more in that category.

- Best for: Visual learners and people who overspend with credit cards.

- Downside: Not very practical in today’s cashless world.

Spreadsheets (Semi-Manual Tool)

Excel or Google Sheets give you full customization. You can track income, expenses, savings, and even create charts to visualize spending patterns. Many free templates are available online to get you started.

- Best for: People who like control and don’t mind updating numbers manually.

- Benefit: Highly flexible and cost-free.

- Downside: Requires discipline—you have to update it regularly.

Budgeting Software (Automated Tool)

Modern apps and platforms take most of the work off your shoulders. Tools like Mint, YNAB (You Need a Budget), PocketGuard, or QuickBooks (for businesses) connect directly to your bank accounts. They track transactions automatically, categorize expenses, and generate easy-to-read reports. Some even set alerts when you’re about to overspend.

- Best for: Busy people who want automation and accuracy.

- Benefit: Saves time, provides insights, and helps set financial goals.

- Downside: Some apps come with subscription fees.

You may also like to read this:

What Is Wealth Building? Guide To Financial Freedom

7 Types of Wealth Building Strategies You Must Know

10 Proven Steps on How To Build Wealth From Nothing In 2025

Why Financial Discipline Matters For Wealth | 7 Key Benefits

12 Wealth Building Habits of Successful People 2025

Choosing the Right Budgeting Tool

Not sure which one to pick? Here’s a quick guide:

- If you’re detail-oriented: Go for zero-based budgeting or apps like YNAB.

- If you prefer simplicity: Incremental budgeting or spreadsheets are your best bet.

- If you need hands-on control: Try the envelope method.

- If you’re running a business or managing projects: Activity-based budgeting or software like QuickBooks is ideal.

- If you want value-driven results: Value-proposition budgeting will keep you disciplined.

Comparison of Budgeting Methods vs. Technological Tools

Here’s a side-by-side look to help you see how the different types of budgeting tools stack up:

| Type | Style | Best For | Strengths | Challenges |

| Zero-Based Budgeting | Method | Detail-oriented planners | Gives every dollar a purpose, highly controlled | Can feel restrictive, requires discipline |

| Incremental Budgeting | Method | People with stable income | Simple, easy to adjust year to year | Not flexible for major life changes |

| Activity-Based Budgeting | Method | Businesses & goal-focused savers | Accurate, connects spending to activities | Requires detailed tracking |

| Value-Proposition Budgeting | Method | Cost-cutters & minimalists | Prioritizes high-value expenses, eliminates waste | Can be tough to decide what has “value” |

| Envelope Method | Tool (Manual) | Visual learners, cash spenders | Helps prevent overspending, easy to follow | Impractical in cashless society |

| Spreadsheets | Tool (Semi-Manual) | DIY budgeters | Fully customizable, free | Needs manual updates & time |

| Budgeting Software | Tool (Automated) | Busy professionals & families | Automated, real-time insights, reporting | Subscription costs for premium features |

Tips for Making Budgeting Tools Work for You

No matter which budgeting method or tool you choose, success comes from consistency. Here are some practical tips to help you stick with your system:

- Start simple. Don’t overwhelm yourself with complicated tools if you’re just getting started. A basic spreadsheet or envelope method works fine.

- Automate when possible. If you’re busy or forgetful, budgeting software can keep things running without much effort.

- Review monthly. Set aside time once a month to review your budget, track progress, and adjust for upcoming expenses.

- Stay flexible. Life changes—so should your budget. Don’t hesitate to switch tools or methods if your current system isn’t working.

- Combine approaches. Some people mix tools. For example, using zero-based budgeting as a method while tracking it through an app or spreadsheet.

Why Using Budgeting Tools Matters

It’s easy to assume you “know” where your money is going, but in reality, small leaks can sink a ship. Those daily coffees, subscription services, or impulse buys add up fast. Budgeting tools aren’t about limiting your fun—they’re about showing you where your money is flowing so you can make smarter choices.

By using the right tool:

- You gain clarity on spending habits.

- You build discipline without relying on willpower alone.

- You create room for savings and investments.

- You reduce financial stress and increase confidence in your money decisions.

Final Thoughts

Budgeting is not one-size-fits-all. Some people love the control of zero-based budgeting, others prefer the simplicity of incremental adjustments, and many lean on apps to do the heavy lifting. The key is finding a balance between strategy (budgeting methods) and practicality (technological tools).

By exploring the different types of budgeting tools, you’ll discover a system that feels natural, sustainable, and empowering. At the end of the day, budgeting isn’t about cutting joy out of your life—it’s about building financial freedom so you can spend money on what truly matters.

So, start small, stay consistent, and let your budgeting tool guide you toward a future of smarter money management.

FAQs

1. What are the main types of budgeting tools?

The two main categories of budgeting tools are budgeting methods (like zero-based, incremental, activity-based, and value-proposition budgeting) and technological tools (like the envelope system, spreadsheets, and budgeting software).

2. Which budgeting tool is best for beginners?

Beginners often find spreadsheets or the incremental budgeting method easiest to start with. They’re simple, flexible, and give you a clear picture of income and expenses without overwhelming details.

3. Are budgeting apps better than manual methods?

It depends on your lifestyle. Budgeting apps like Mint or YNAB are great for automation and convenience, while manual methods like the envelope system provide hands-on control. The best choice is the one you’ll stick with consistently.

4. How do I choose the right budgeting tool for me?

Ask yourself:

Do I want full control? → Try zero-based budgeting.

Do I prefer simplicity? → Go with incremental budgeting or spreadsheets.

Do I overspend easily? → The envelope method helps keep you disciplined.

Do I run a business? → Activity-based budgeting or software like QuickBooks may be better.

5. Can I use more than one budgeting tool at the same time?

Yes! Many people combine approaches. For example, you could use zero-based budgeting as your method and track it with a spreadsheet or budgeting app. Mixing tools can give you the best of both worlds.