Managing your money wisely can feel overwhelming, especially if you’re just starting your financial journey. Many beginners struggle with where to start, and it’s easy to feel lost amid bills, debts, and savings goals. The good news is that you don’t need to be a financial expert to take control of your finances.

By following practical strategies, you can start building a secure future and feel confident about your money. Here’s a detailed guide with the best personal finance tips for beginners to help you start your journey with clarity and confidence.

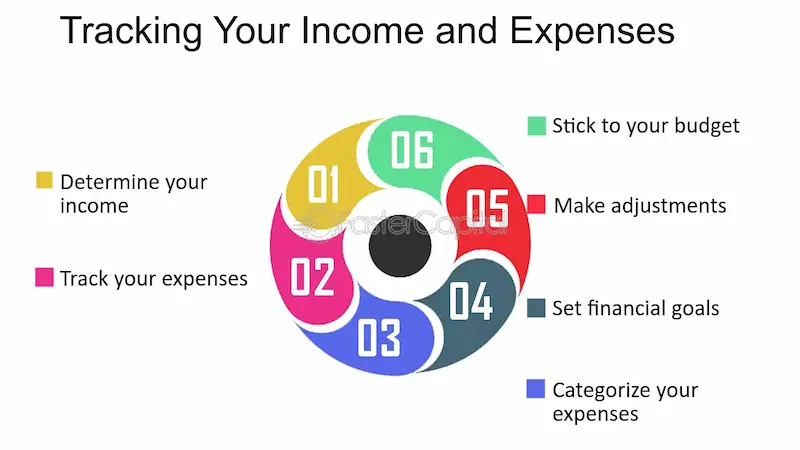

1. Track Your Income and Expenses

Before you can make smart financial decisions, you need to understand exactly where your money is going. Tracking your income and expenses gives you a clear picture of your financial habits.

- How to start: List all your income sources, including salary, freelance earnings, or side gigs. Then, write down every expense for at least one month.

- Tools you can use: Budgeting apps like Mint, YNAB (You Need a Budget), or even a simple spreadsheet can simplify the process.

- Why it matters: When you know exactly how much you’re spending on groceries, subscriptions, dining out, or entertainment, you can identify areas to cut back and redirect money toward savings or debt repayment.

Tip: Categorize your expenses into fixed (rent, utilities) and variable (entertainment, shopping) to see where you can realistically reduce spending.

2. Create a Realistic Budget

A budget is your roadmap to financial freedom. It’s not about restricting yourself; it’s about knowing how to use your money effectively.

- Step-by-step budgeting: Start by allocating your income into categories: essentials (50%), wants (30%), and savings or debt repayment (20%). This is the classic 50/30/20 budgeting rule.

- Be flexible: Your budget should reflect your lifestyle, goals, and responsibilities. If you have student loans or high-interest debt, adjust the savings and debt repayment portion accordingly.

- Track progress: Check your budget weekly or monthly to ensure you’re staying on track. Budgeting isn’t a one-time activity—it evolves as your financial situation changes.

Example: If you earn $3,000 per month, allocate $1,500 for essentials, $900 for discretionary spending, and $600 for savings and debt repayment.

You may also like to read this:

What Is Personal Finance Management: Everything Explained

10 Types of Personal Finance Planning: Complete Guide

Easy Guide on How To Create A Monthly Budget Plan

Top 10 Reasons Why Saving Money Is Important For Your Future

3. Build an Emergency Fund

Life is unpredictable, and unexpected expenses—like medical bills, car repairs, or sudden job loss—can disrupt your finances. An emergency fund acts as a safety net.

- Start small: If $500–$1,000 seems manageable, begin with that. Over time, aim for 3–6 months’ worth of living expenses.

- Where to keep it: Use a separate high-yield savings account, so you’re not tempted to spend it.

- Peace of mind: With an emergency fund, you won’t need to rely on high-interest credit cards or loans when life throws you a curveball.

Tip: Treat contributions to your emergency fund as mandatory, just like paying a bill each month.

4. Pay Off High-Interest Debt First

Debt can feel like a heavy weight, especially when interest rates are high. Paying off debt strategically is one of the best ways to improve financial stability.

- Focus on high-interest debt: Credit cards and personal loans often have high interest rates. Paying these off first reduces the total interest you’ll pay over time.

- Debt repayment strategies:

- Avalanche method: Pay off the debt with the highest interest rate first.

- Snowball method: Pay off the smallest debts first for quick wins and motivation.

- Avalanche method: Pay off the debt with the highest interest rate first.

- Stay consistent: Even small extra payments can significantly reduce debt over time.

Example: If you have a $1,000 credit card balance at 20% interest, paying an extra $50 each month can save you hundreds in interest.

5. Automate Your Savings

One of the easiest ways to save is to make it automatic. Automation ensures you save consistently without thinking about it.

- How to automate: Set up automatic transfers from your checking account to a savings or investment account each month.

- Benefits: You avoid the temptation to spend the money, and your savings grow steadily over time.

- Start small: Even $50–$100 per month adds up. The key is consistency, not the amount.

Pro Tip: Consider “paying yourself first.” Treat your savings contribution as a non-negotiable expense before spending on discretionary items.

6. Start Investing Early

Investing might seem intimidating, but starting early—even with small amounts—can create significant wealth over time, thanks to compound interest.

- Beginner-friendly investments: Index funds, mutual funds, and retirement accounts like a 401(k) or IRA are good options for beginners.

- Long-term perspective: Avoid short-term thinking. Investments typically grow over years, not days.

- Compound interest: The earlier you start, the more your money works for you. Even small monthly contributions can grow into a substantial nest egg over decades.

Example: Investing $200 per month starting at age 25 can grow to over $200,000 by age 60, assuming a 7% average annual return.

7. Educate Yourself About Personal Finance

Knowledge is power when it comes to money. Understanding financial concepts helps you make informed decisions and avoid costly mistakes.

- Resources to explore: Books, podcasts, online courses, and blogs focused on budgeting, investing, and managing debt.

- Key topics to learn: Compound interest, credit scores, diversification, risk management, and asset allocation.

- Stay updated: Financial rules and products change. Continuous learning ensures you make choices that align with current best practices.

Tip: Start with one financial concept per month and gradually expand your knowledge.

8. Live Below Your Means

Many beginners fall into the trap of lifestyle inflation—spending more as income rises. Building wealth requires discipline and mindful spending.

- Practical tips: Avoid unnecessary subscriptions, impulse purchases, and buying luxury items before financial stability.

- Focus on essentials: Prioritize needs over wants and find satisfaction in simple living.

- Savings boost: By spending less than you earn, you free up more money for savings, investments, and emergency funds.

Example: If your salary increases by $500, resist the urge to spend it all. Allocate at least 50% of the increase toward savings.

9. Set Clear Financial Goals

Having clear financial goals gives direction and motivation. Without goals, it’s easy to drift financially.

- Types of goals: Short-term (saving for a vacation), medium-term (buying a car), long-term (retirement or homeownership).

- Break them down: Divide bigger goals into smaller, achievable steps to track progress.

- Stay accountable: Write your goals down and review them regularly to stay motivated.

Tip: Use SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound—for clarity and focus.

10. Review and Adjust Your Plan Regularly

Personal finance is dynamic. Life changes, and so will your income, expenses, and priorities. Reviewing your plan ensures you stay on track.

- Frequency: Reassess your budget and financial goals at least every 3–6 months.

- Make adjustments: Update for new income, unexpected expenses, or changes in financial priorities.

- Stay proactive: Regular review helps you identify problems early and seize opportunities to save or invest more effectively.

Tip: Treat financial reviews like a health check-up—small adjustments now can prevent bigger problems later.

Final Thoughts

Starting your financial journey may seem daunting, but following the best personal finance tips for beginners can make a huge difference. Tracking your spending, creating a budget, building an emergency fund, paying off debt, saving automatically, investing, educating yourself, living below your means, setting goals, and regularly reviewing your plan are all practical steps toward financial security.

Remember, financial success doesn’t happen overnight. Every small step you take today—no matter how minor—builds momentum for a secure and stress-free future. Start now, stay consistent, and watch your confidence grow as your financial life transforms.

FAQs: Best Personal Finance Tips for Beginners

1. What are the best personal finance tips for beginners?

The best personal finance tips include tracking your income and expenses, creating a realistic budget, building an emergency fund, paying off high-interest debt, automating savings, investing early, and continuously educating yourself about money management.

2. How do I start managing my finances as a beginner?

Start by tracking all your income and expenses for a month to understand your spending habits. Then, create a simple budget, set financial goals, and prioritize saving and debt repayment. Using apps or spreadsheets can make this process easier.

3. How much should a beginner save each month?

Beginners should aim to save at least 20% of their monthly income. If that’s challenging, start small—$50–$100 per month—and gradually increase savings as you adjust your budget and reduce unnecessary expenses.

4. Why is an emergency fund important for beginners?

An emergency fund acts as a safety net for unexpected expenses like medical bills, car repairs, or sudden job loss. It prevents reliance on high-interest loans or credit cards and gives peace of mind.

5. How can I pay off debt faster as a beginner?

Focus on high-interest debt first using strategies like the avalanche method (paying off the highest interest first) or snowball method (paying off smaller debts first). Make consistent payments and consider using any extra funds to reduce balances faster.